United Kingdom – The global petrochemicals market is grappling with unprecedented challenges as oversupply intensifies, driving utilization rates to record lows and squeezing profit margins for chemical producers worldwide.

This predicament, although anticipated due to substantial capacity expansions, has been exacerbated by unexpectedly sluggish demand growth and the looming prospect of additional capacity influx within the next five years, according to insights from James Wilson, Senior Petrochemical Analyst at ICIS.

The ongoing downcycle in the petrochemicals industry is marked by a convergence of factors. The considerable capacity build-out, a long-foreshadowed development, has collided with lackluster demand expansion. Even the resilience displayed by chemicals demand post the initial wave of the pandemic has waned, falling significantly below pre-pandemic expectations. The Russia-Ukraine war has further compounded challenges, triggering soaring energy prices and inflation, thus curbing demand.

Global impact

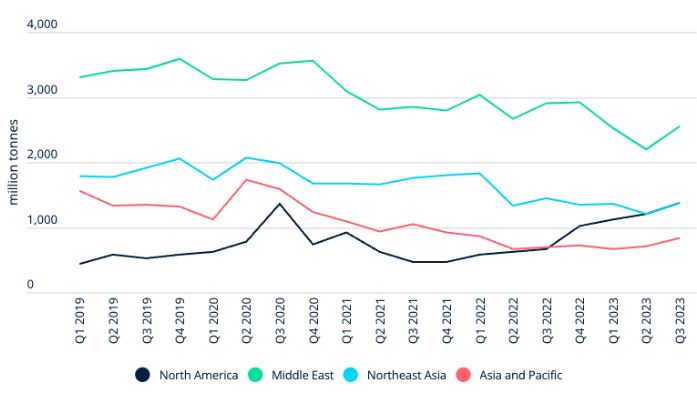

Projections for 2024 indicate a more than 6% dip in global ethylene demand compared to pre-pandemic estimates. This plunge has reverberated across all regions, impacting operating rates and margins, even for feedstock-advantaged producers in the US and the Middle East. China, a key player as the world’s largest chemicals importer, has witnessed a substantial decline in imports of ethylene derivatives, down by around 20% in the first nine months of 2023 compared to 2020.

China’s dominance in olefin and aromatics capacity additions between 2020-2024 (around 75%) has reshaped dynamics, affecting other Asian producers significantly. Asia’s cracking margins turned negative in late 2021, leading to a record number of plants idled. Asia’s exports to China have plummeted by over one-third. The Middle East, despite increases in crude and liquefied petroleum gas (LPG) exports, has seen chemical market share decline. In contrast, the US has witnessed a surge in exports to China, doubling in the first nine months of 2023 compared to 2020.

Strategic investments

Facing declining market share, Middle Eastern producers are gearing up for strategic investments in chemicals, including crude-oil-to-chemical complexes. These initiatives aim to secure offtake for oil and refined products post-peak oil, and enhance value-added exports by bringing chemicals production onshore. The region anticipates large-scale investments in the second half of the decade.

As the global petrochemicals market navigates this intricate landscape, the industry’s resilience and adaptability will be tested, with the outcome shaping the trajectory of key players in the years ahead.