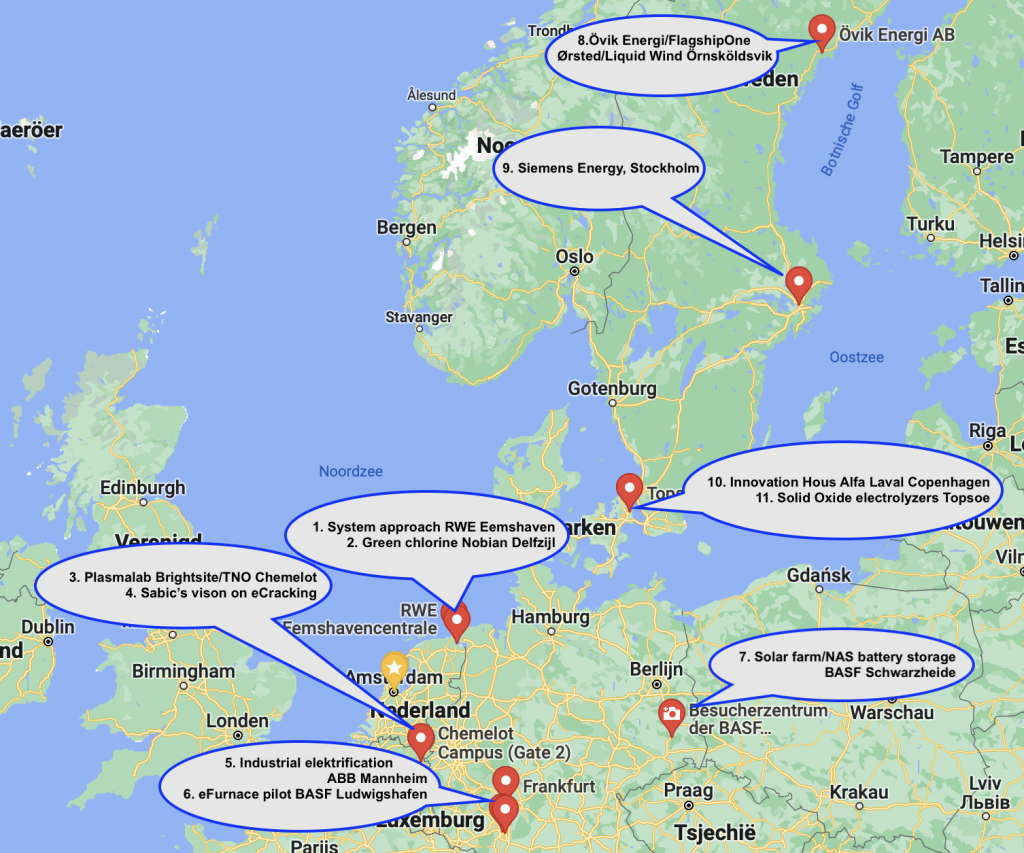

Europe – Last summer, Industryandenergy.eu and VoltaChem traveled through Europe for Electe23. Together with students and young professionals, they visited various industrial electrification projects, from the pilot electric cracker in Ludwigshafen to central Sweden where an innovative eMethanol plant is being built. The train journey of almost 5,000 kilometers provided an interesting insight into the electrification of the industry. An important solution direction for the much-needed transformation of European industry.

There are several roads that lead to Rome, as was shown once again during the Electro Trail Europe 2023 (Electe23), at the beginning of this summer. Electe23 visited large, existing industry clusters, such as Chemelot (southern Netherlands) and BASF Ludwigshafen. The travelers also visited Örnsköldsvik in central Sweden, where a completely new chain for methanol produced from biogenic CO2 and green hydrogen will soon arise alongside a relatively small biomass plant.

Neclected roads

When it comes to electrifying industries, new roads are needed. Think of electrochemical pathways. At the same time, existing technology can also be incorporated here and there. For example, DC converters seemed to be on the decline for a long time, but the rise of green hydrogen production, among other things, is breathing new life into the 80-year-old technology. There are even neglected roads that suddenly become usable again, possibly with a thorough renovation. Especially because the climate problem requires different choices than before. Forgotten processes get a new chance. Plasma technology is a good example of this.

Plant by plant

It was also noticeable that the existing industry seems to be moving, but that new companies and challenging forms of collaboration are also emerging. At the same site in Ludwigshafen where BASF is forced to close a number of factories, the chemical group is also vigorously building a pilot for electric cracking. Together with also industrial giants Linde and Sabic. The next step is an electric cracker on a global scale, as part of existing, transforming chemical clusters. As if closing factories makes room for new developments.

The concept of scale-up Liquid Wind is very different again. That starts with several large partners on a whole new industry; the production of methanol from biogenic CO2 and green hydrogen. After the first example factory, more will follow. Plant by plant. Location for location. Not necessarily in existing industrial clusters. But there where the situation, such as geographical circumstances, offers the most opportunities.

New forms

Even within large corporations, the situation seems to dictate a variety of solutions. Just last year, BASF Ludwigshafen announced another major study into the application of industrial electric heat pumps. The results turned out to offer less perspective than hoped. At the large BASF site in Schwarzheide, hopes were pinned on geothermal energy. However, there, in the east of Germany, usable sources for geothermal energy turned out to be too deep under the earth’s surface. And it is precisely in Ludwigshafen that such sources are more accessible.

Electrification of the process industry is therefore a direction with different manifestations. Geographical location, history, old and new forms of cooperation, existing and new technology; they determine the possibilities, which also differ per situation. In this article, therefore, a selection of the various insights during Electe23.

Electrical cracking

Steam crackers, which convert naphtha and/or liquefied natural gas into chemical building blocks, in particular ethylene and propylene, emit about thirty megatons of CO2 per year in Europe. The stoves of the steam crackers are mainly responsible for this. They use fossil fuels to reach the desired temperature of roughly 850 degrees Celsius. “More than eighty percent of all chemicals in the world are produced from ethylene and propylene. So if you make it green, the entire value chain behind it becomes green’, says TNO expert Reinier Grimbergen, who was on Trail on behalf of knowledge platform VoltaChem.

That is why several consortia are currently investigating alternatives. Electric cracking seems to have the best credentials. With renewable energy, this technology, in combination with other measures, can greatly reduce and even minimize greenhouse gas emissions.

Domestic sites

Perhaps the most progressive at the moment in this area is the collaboration between BASF, Sabic and Linde. They are already building a large demonstration installation on BASF’s large Verbund site in Ludwigshafen. This electrically powered stove will be fully integrated into one of the existing steam crackers from the end of 2023. The plant will test two different heating concepts, process about four tons of hydrocarbons per hour and consume six megawatts of renewable energy.

BASF and Sabic jointly invest in the project and the demonstration plant will be operated by BASF. Linde is the technology partner for the project and wants to further commercialize the developed technology in the future.

It is all the more striking because the chemical industry is currently struggling in Europe. The domestic sites in particular are suffering from the enormous natural gas prices. For example, BASF feels compelled to close several factories in Ludwigshafen. Electrification of factories not only offers an opportunity to become more sustainable, but also a possible way out of dependence on natural gas.

Four to five times

However, chemical companies will then be faced with other challenges. After all, how will they get enough green energy in the future? In addition to the desired growth of green electricity, it is particularly important to upgrade the electricity grid. All the more so because in addition to industry, various other sectors are also using more and more electricity, such as households and transport.

In industry alone, there is a huge increase in demand. Or as Jan Remeysen, CEO of BASF Antwerp, once outlined it for his site: ‘We have made our calculations. If we continue to electrify and in the long run also electric cracking, we will need four to five times as much power at BASF Antwerp. That requires huge investments in infrastructure, if only to get that power here.’ Comparable calculations have been made for Chemelot and Ludwigshafen. And, unlike the clusters at sea, they do not have the advantage of a direct connection to, for example, offshore wind farms that are planned or even under construction.

eMethanol

While existing industry is mainly focused on innovation, transformation and even survival, it is also challenged by new companies and partnerships at the same time. They are often less tied to existing chains and can therefore choose the situation and largely adapt it to their own needs.

Consider, for example, Liquid Wind. The scale-up brought together several companies for its so-called FlagshipONE – the first factory for the production of eMethanol. Large and medium-sized parties, each larger than themselves. As the founder of the project, Liquid Wind is by far the smallest of the bunch. But it does keep all members together, also for follow-up projects. Liquid Wind CEO Claes Fredriksson during Electe23 stated almost paternally: ‘You don’t say goodbye to your children, do you?’.

Örnsköldsvik

The FlagshipONE is now under construction in Örnsköldsvik, Sweden. Energy giant Ørsted has now acquired all property rights to this first project. But Siemens Energy, Topsoe, Alfa Laval, Uniper, Carbon Clean, Elyse Energy and Hycap also continue to contribute. And therefore also remain closely involved in FlagshipTWO, -THREE and beyond. They will each provide a puzzle piece for the new chains for the production of eMethanol from biogenic CO2 and hydrogen. For example, Siemens will supply the electrolyzers and process automation, Topsoe will provide the technology to capture CO2 and Uniper will produce the required hydrogen. The advantage of such a collaboration is that each follow-up project can benefit from improvements and innovations made by each partner individually. Moreover, by using digital twins of the installations, innovations can first be tested extensively before they are actually applied. In any case, the capacity of the installation will be doubled in the second and third projects compared to the factory in Örnsköldsvik.

Shipping

For future projects, the consortium is always looking for new locations that are suitable for the production of eMethanol. The first condition is the availability of biogenic CO2. For FlagshipONE, the choice therefore fell on Örnsköldsvik in central Sweden. There, energy company Övik operates a biomass power plant (see photo), based on waste from the wood processing industry. It is obvious that many follow-up installations will end up in Scandinavia, where various biomass plants burn waste from the wood industry, so that sufficient biogenic CO2 is available. But a country like Canada also seems to offer many opportunities.

At the end of 2022, Ørsted took the final investment decision for the construction of the factory in Örnsköldsvik, which will soon have a capacity of 50,000 tons per year. FlagshipONE is expected to be commissioned in 2025 and the methanol is primarily intended as fuel for shipping. Global shipping is responsible for about three percent of global carbon emissions.

Developments in electrolyzers

An important success factor for new electrochemical projects is innovation in the field of electrolyzers. It is important, among other things, that they become more affordable and efficient, in order to make electrochemical production of hydrogen, among other things, more competitive.

Two types of electrolyzers are currently in vogue: alkaline and PEM (proton-exchange membrane). The advantage of alkaline is that it is a proven technology that has been around for about 100 years. It is a technology that is well known. In addition, it is currently significantly cheaper than PEM, about half.

But PEM also has advantages. Alkaline electrolyzers can take up to fifty minutes to reach full speed. PEM less than five minutes and can therefore respond more flexibly to supply and demand. Another advantage of PEM is that they take up much less space and are much lighter. This can be advantageous if less space is available, but also if the factories have to be built on remote or inhospitable terrain. PEM electrolyzers are much more handy and you can replace them like cartridges after many operating hours. Costs may still be a problem at the moment, but they can be expected to decrease. It is a disadvantage that PEM requires expensive and scarce iridium and platinum, although about ninety percent of these platinum group metals (PGMs) can be recycled. It is mainly a consideration for each project which technology is preferable.

Exotherm

Thus, while the electrolysis market is currently dominated by alkaline and PEM technologies, solid oxide (SOEC) based electrolyzers are gaining ground. This technology works at higher temperatures and is therefore much more efficient than Alkaline and PEM. The difference in efficiency can be as much as 25 percent.

The disadvantage is that SOEC is currently still significantly more expensive than PEM and that an external heat source is always required. Which makes the technology more attractive on a factory site with many processes, where a lot of heat is available.

Accelerate

Electe23 visited Topsoe in Lyngby, Denmark, one of the leaders in the development of SOEC technology. The technology company is currently building one of the largest SOEC electrolyzer plants in the world in Herning, Western Denmark. The plant’s production capacity is 500 megawatts per year with an option to expand to five gigawatts of electrolyzer capacity. According to Peter Blennow, senior specialist at Topsoe, there is already a growing market demand for this technology. “It is especially important for Topsoe to accelerate development, in order to be an important player in this market in the future.”

Electromagnetic electrolyzer

And there are other developments as well. For example, during a visit to Alfa Laval’s Innovation House in Copenhagen, the Electe23 travelers came “face to face” with an electromagnetic electrolyzer. According to starter Hymeth, its patented Hyaeon can produce hydrogen at a cost saving of more than forty percent compared to existing alkaline electrolyzers. Moreover, no rare metals such as platinum or iridium are needed.

Hyaeon is a further development of alkaline technology. According to Hymeth, it contains radical innovations: think of a new electrocatalyst without precious metal alloy, it can deliver high-compression gas and the light and compact electrolyzer reduces the space requirement.

Co-production of chemicals

Anyone who wants to explore the future of the chemical industry should take a look at Nobian at Chemie Park Delfzijl. An indispensable stopover for Electe23. In the Membrane Electrolysis Company, the chemical company produces chlorine, caustic soda and hydrogen from brine. Power-to-X is therefore not just a thing of the future, it has been happening in chlorine production for a long time.

It is also interesting that Nobian produces three valuable products at the same time: chlorine, caustic soda and hydrogen. Since the required power has been produced green, Nobian is even allowed to label these products as green. What is special is that, with the electrolysis plants in Rotterdam and Delfzijl, Nobian can call itself the largest producer of green hydrogen in the Netherlands, with more than 200 megawatts of production capacity.

Limited

Previously, hydrogen was only a by-product of chlorine production, but it is now a highly sought-after chemical building block and energy carrier. Much attention is currently being paid to the electrolysis of water. The advantage of water electrolysis is that the raw material is abundantly available. But at the same time there are also disadvantages. The splitting of water into hydrogen and oxygen takes a lot of energy. And oxygen has hardly any market value. That makes this route for hydrogen production expensive.

So why not combined hydrogen production from valuable co-products, so that the benefits outweigh the costs? In the case of Nobian, it is a pity that the market demand for chlorine is limited. As a result, hydrogen production via this route is also immediately limited. Combining hydrogen production with another commodity could offer a solution.

Plasma

That is why the visit to the Brightsite plasma lab at Chemelot during Electe23 was so interesting. Together with the University of Maastricht, TNO and Sitech are fanatically investigating the possibilities of co-production of hydrogen and ethene or acetylene. Three hugely important building blocks for the chemical industry.

From methane, yes. However, in addition to natural gas, methane is also a residual gas from crackers. This will make the combination with electric cracking very interesting, for example. In an electric stove, methane is a by-product that is no longer needed as a direct fuel to keep its own process going, as in traditional crackers. So it kills two birds with one stone: an extra sustainability step and extra chemical building blocks.

The plasma lab at Chemelot should accelerate the development of this technology. TNO researcher Hans Linden: ‘We have taken the first steps with acetylene. We now have plans for the construction of a serious pilot plant in Geleen, with dimensions of approximately ten by fifteen metres. For the time being, the major challenge is to make this route affordable.’ For example, if the CO2 price continues to rise, this route may eventually settle itself.

The fact that acetylene is very reactive offers interesting opportunities for chemistry on the one hand, but also major challenges for storage. That is why the plasma laboratory is also investigating routes to produce ethylene, the most commonly used building block in current chemistry, from methane. The advantage is that ethylene is much more manageable. Linden: ‘We can produce ethylene by using part of the hydrogen to hydrogenate acetylene. But then you still sacrifice a significant part of your hydrogen. It would therefore be better if we could produce high percentages of ethene ourselves in the plasma process. That is a challenging puzzle.”

From existing to new

Not only chemical clusters such as BASF’s Verbund sites in Ludwigshafen, Antwerp and Schwarzheide will undergo a complete transition in the coming decades. Many power plants are also undergoing a total metamorphosis. This became apparent during the visit to the RWE power plant in Eemshaven. The ultramodern coal-fired power station has already been partly converted to biomass, but that is only the beginning.

RWE also recently bought Vattenfall’s adjacent natural gas-fired Magnum power station, which will soon also be able to burn hydrogen. And it doesn’t stop there. In ten years’ time, RWE’s contiguous site in Eemshaven will be transformed into an energy and raw materials hub. Think of green hydrogen production, including with the power from the Hollandse Kust West (HKW) VII offshore wind farm, which the energy group is currently constructing, with a capacity of 760 megawatts. The hydrogen can be supplied to chemical factories in the Eemsdelta, among others.

There are also plans for electricity storage in batteries and the first industrial-scale Battolyser has also recently been installed at Magnum power station. It is a combination of a battery and an electrolyzer in one device. Once the system’s battery is charged, the Battolyser can produce hydrogen with the excess stream. If there are shortages on the electricity grid, a Battolyser can supply the stored electricity to the electricity grid.

DC

Another example from existing to new is the revival of direct current technology. While several competitors said goodbye to DC equipment, such as DC converters, a company like ABB kept this technology on board. And with success Although alternating current is the standard for the electricity that comes from our sockets today, direct current is making a comeback.

Water electrolysis, for example, requires low-voltage direct current. The usual way is to supply renewable electricity for the production of green hydrogen via an AC grid connection that converts DC to AC and AC back to DC. Business development manager Frank Jüngst, during a visit to ABB in Mannheim: “Not so long ago everyone thought that the market for DC technology would disappear, but we are now seeing more and more opportunities. Especially in the field of electric heating and of course also the electrolyzers. The hydrogen business is really booming. It does not matter whether it is an alkaline, PEM or SOEC installation. We can equip it with existing DC parts. Based on more than eighty years old and therefore proven technology.”