The continent’s reliance on clean technology becomes ever more crucial. To safeguard its energy transition against supply chain vulnerabilities, Europe must bolster its domestic clean-tech manufacturing while pursuing diversified supply chains and sustainable practices.

Think tanks Agora Energiewende and Agora Industry, in collaboration with consultancy Roland Berger, have unveiled a comprehensive analysis highlighting the minimum manufacturing targets needed to enhance the resilience of Europe’s clean-tech value chains.

A Strategic imperative

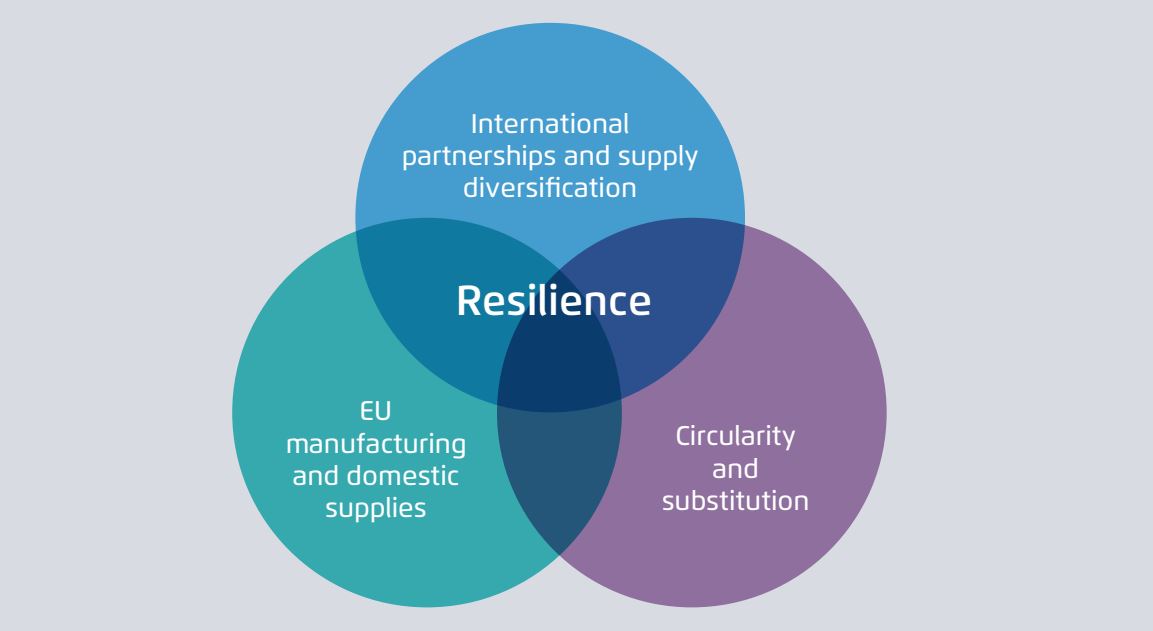

Europe’s journey towards climate neutrality hinges on a range of clean technologies, including solar panels, wind turbines, batteries, heat pumps, and electrolyzers. These clean-tech value chains, however, are not immune to disruption. To fortify the energy transition, Agora’s analysis suggests minimum shares of EU manufacturing across various clean-tech sectors. These targets aim to ensure the resilience of Europe’s clean-tech value chains and underpin its commitment to a sustainable future.

For instance, the analysis proposes a 55 percent EU-manufacturing share for Lithium Iron Phosphate (LFP) batteries and 58 percent for Lithium Nickel Manganese Cobalt Oxide (NMC) cells, significantly higher than current shares of 12 percent and 50 percent, respectively.

Setting the Manufacturing Bar High

In the realm of solar photovoltaic (PV) technology, the recommended minimum shares include 55 percent for wafers, 50 percent for cells, and 51 percent for modules, far surpassing the current shares of 2 percent, 4 percent, and 28 percent, respectively.

These targets, meticulously calculated by Agora, aim to secure Europe’s clean-tech manufacturing base, but they also reflect the imperative to minimize supply chain vulnerabilities.

Funding the Future of Clean Tech

However, achieving these manufacturing targets necessitates substantial investment. Agora estimates that public funding requirements to scale EU manufacturing to these recommended levels range from 10 to 30 billion euros until 2027 and 33 to 94 billion euros from 2028 to 2034. A significant portion of this funding aims to reduce operational costs.

Crucially, the analysis reveals that current public funding commitments, particularly post-2027 when the current EU budget period ends, fall short of what is needed to meet these ambitious targets.

The Path Forward

A comprehensive policy framework is essential to stimulate investment in European clean-tech manufacturing and ensure the sector’s long-term competitiveness without continuous public support. Agora suggests a seven-point policy package, including a dedicated fund to close capital and operational expenditure gaps, a clean-tech manufacturing contribution to finance the fund, favorable investment and financing conditions, and market differentiation based on superior sustainability performance for EU-manufactured products.

This policy package seeks to address the higher production costs in Europe, allowing the clean-tech sector to thrive independently in the future.

Global Cooperation for Resilience

A crucial aspect of building resilience in Europe’s clean-tech manufacturing sector is cooperation with global technology and value chain leaders. Governments should actively invite leading clean-tech suppliers to establish manufacturing facilities in Europe. However, this cooperation should come with safeguards to ensure companies’ long-term commitment and a gradual reduction of value-chain dependencies.