A recent study by the Hydrogen Council indicates a fast expansion in hydrogen schemes in response to government promises to deep decarbonization.

Produced in conjunction with McKinsey & Company, “Hydrogen Insights2021: A Perspective on Hydrogen Investment, Deployment and Cost Competitiveness” provides a detailed view on global business deployment, investment momentum and impacts on the cost competitiveness of hydrogen solutions.

Worldwide promotion

As of early 2021, more than 30 countries have provided hydrogen roadmaps, and policymakers around the world have pledged public funds to promote decarbonization by hydrogen technologies. No fewer than 228 big ventures have been announced along the supply chain, with 85 percent based in Europe, Asia and Australia.

This include large-scale industrial use, transport applications, advanced hydrogen economy, infrastructure and giga-scale production projects. If all the projects proposed come to fruition, overall spending will cross more than $300 billion in expenditure by 2030.

Of this spending, $80 billion will actually be considered “mature” – meaning that these projects are at the planning stage, have passed a final investment decision (FID) or are under construction, either commissioned or operational.

Attractive option

Anticipating sustained growth in volume, the study indicates that, from a Total Cost of Ownership (TCO) perspective, hydrogen will become the most attractive low-carbon option in more than 20 applications by 2030, including long-haul trucking, transportation and steel. Two things would be crucial in achieving this result: first, it is important for policymakers to continue their commitment to deep decarbonization, supported by financial resources, legislation and consistent hydrogen plans and goals, and to convert them into long-term regulatory regimes.

Second, implementation methods would target key ‘unlocks’ such as reducing the expense of hydrogen processing and delivery that would have the most important effect on the rest of the market.

Three cluster forms

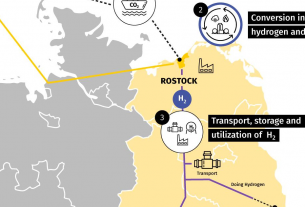

Deployment across clusters of strong off-takers can help suppliers spread both investment and risk while building constructive feedback loops. Three cluster forms are now gaining traction: 1) manufacturing centers that support refining, power generation and fertilizer and steel production; 2) export centers in resource-rich countries; and 3) port areas for fuel bunkering, port logistics and shipping. The reduced costs of clusters would allow global hydrogen trading, linking potential major demand centers such as Japan, South Korea and the European Union to plentiful low-cost hydrogen-producing regions such as the Middle East, North Africa, South America and Australia.